How to Shop for Term Life: State Farm!!!

Every customer goes through the buyer’s journey. Part of this journey includes considering and researching different companies and their product, and further comparing these products to discover the best. In this article, I will be guiding prospective customers through a step-by-step guide for obtaining a Life Insurance Quote with State Farm Insurance.

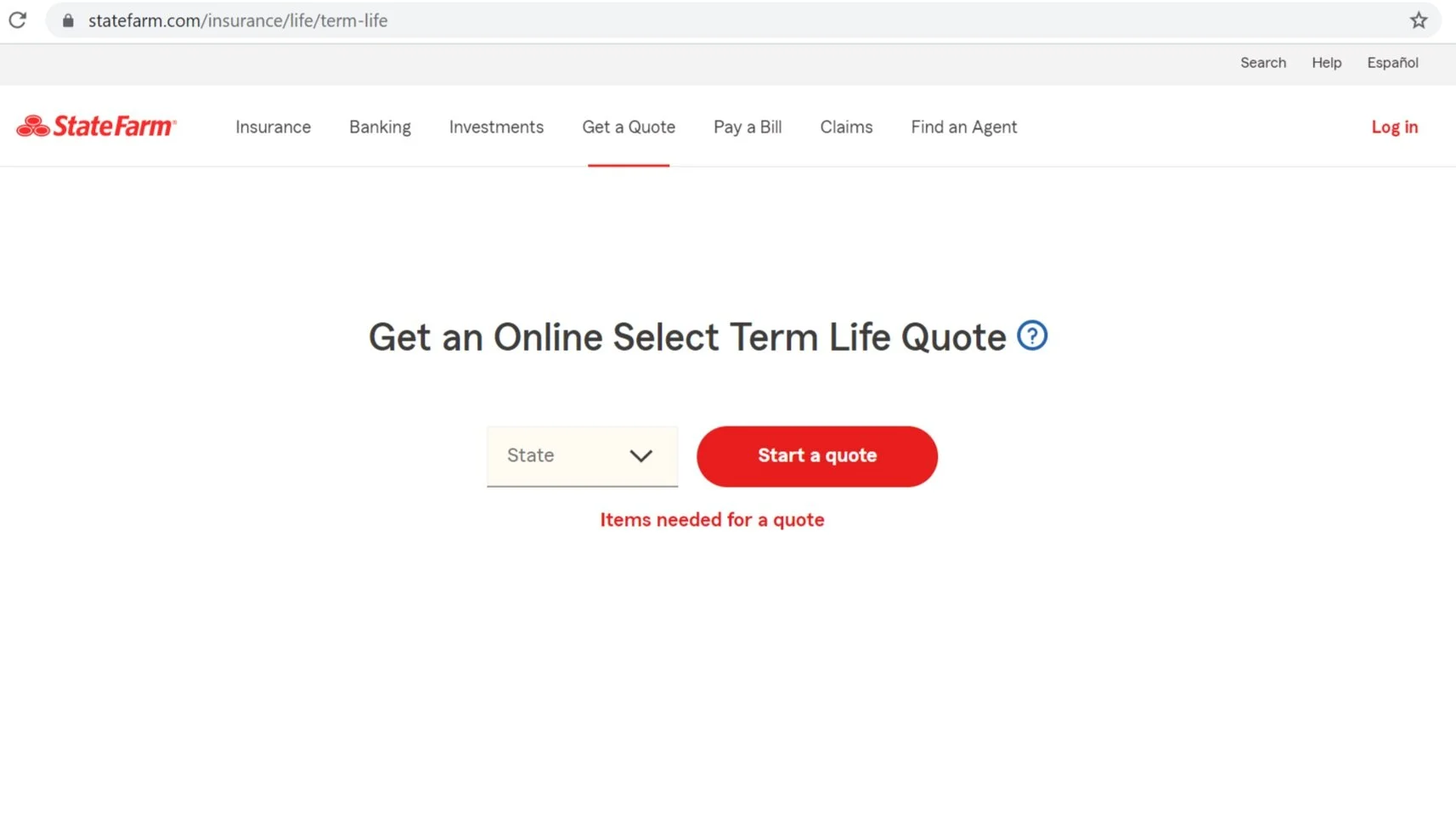

STEP 1:

Find the “Get A Quote” Page on State Farm’s Website

First, you need to scroll through State Farm’s website to find their quote page. To simplify this navigation, the link is written below. After clicking on the link, your page should look like the screenshot above. Fill out the state that you reside in, and click on “Start a quote.”

(I put New York as the state I reside in).

STEP 2: Fill In Your Information

State Farm will first ask you if you are seeking a term life quote for yourself. Reasoning behind this is to gage their audience, and who may be filling this information out. After answering this, you will be asked a series of questions, which are circled in the illustration above. Insurance companies base their prices on demographic factors such as gender, state of residence, height, weight, health status, and whether or not you use tobacco.

(The quote above is for a 35 year old, 5”4, 140 lb female in good health who does not use tobacco).

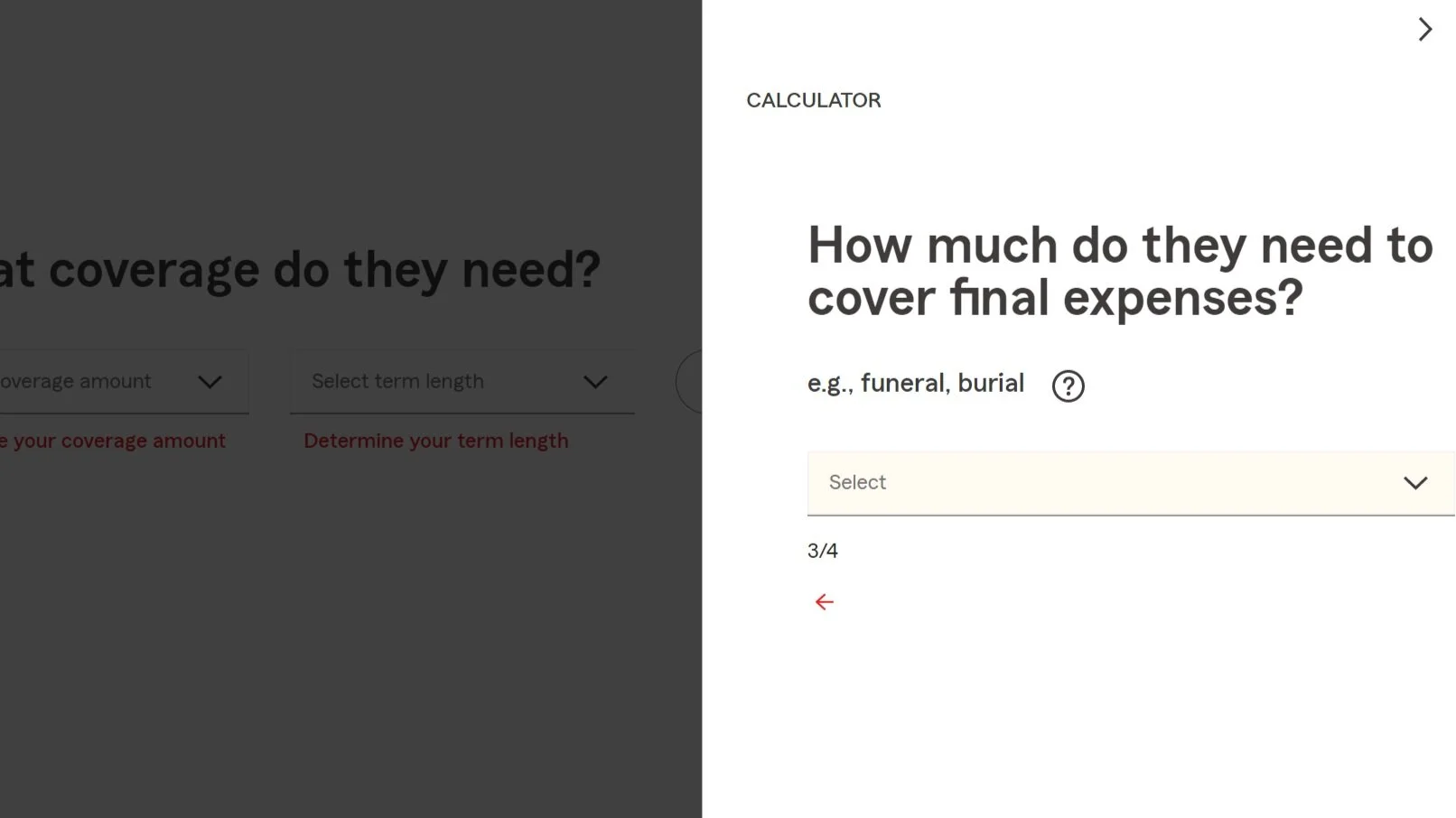

STEP 3: Pick Your Term Duration and Coverage Amount

After entering your personal information above, you are required to choose the amount of coverage and the term length that you desire. On average, people select the 20-year plan, and the $1,000,000 in coverage, which I did in this example. You can select any amount of coverage you need, which is illustrated above, with possible term lengths of 10, 20, or 30 years. Coverage Duration and Coverage Amount affect the price of your premiums greatly.

Calculate Your Needs

When shopping for Life Insurance, it is essential to calculate your needs. State Farm offers a free calculator which allows you to calculate your future financial needs. The questions you are required to answer are illustrated above (debt, inheritance amount, final expenses, educational expenses).

STEP FOUR: Get Your Quote!

After all of your information is filled out, you will be asked if you want to add anything else on to your policy, and after answering “No,” you will receive your finalized monthly quote. Compared to other companies, this is a more expensive premium.

Using this step-by-step guide, you can now go get a quote for State Farm’s term life insurance!