How to Shop for Term Life: Haven Life Edition

Getting a free quote from an insurance company is a necessity while picking which policy fits your needs the best. It is important to see how each company stacks up, so in the end your decision can be made fairly clear. In this article, I will be providing you with yet another step by step guide on how to receive a free quote, this time focusing on Haven Life.

STEP 1:

Find the “Get A Quote” Page / Check Your Price on Haven Life’s Website

By simply browsing through Haven Life’s website, you can find the “Check your price” button, which immediately leads you to their free quote page. To simplify your navigation, the link to this page is written below. After clicking on the link, you are free to start answering the questions asked in order to determine the monthly price of your insurance.

STEP 2: Fill In Your Information

Insurance companies base their prices on demographic factors such as gender, state of residence, height, weight, health status, and whether or not you use tobacco. All of these factors come into play while calculating an average life expectancy for the human in questions.

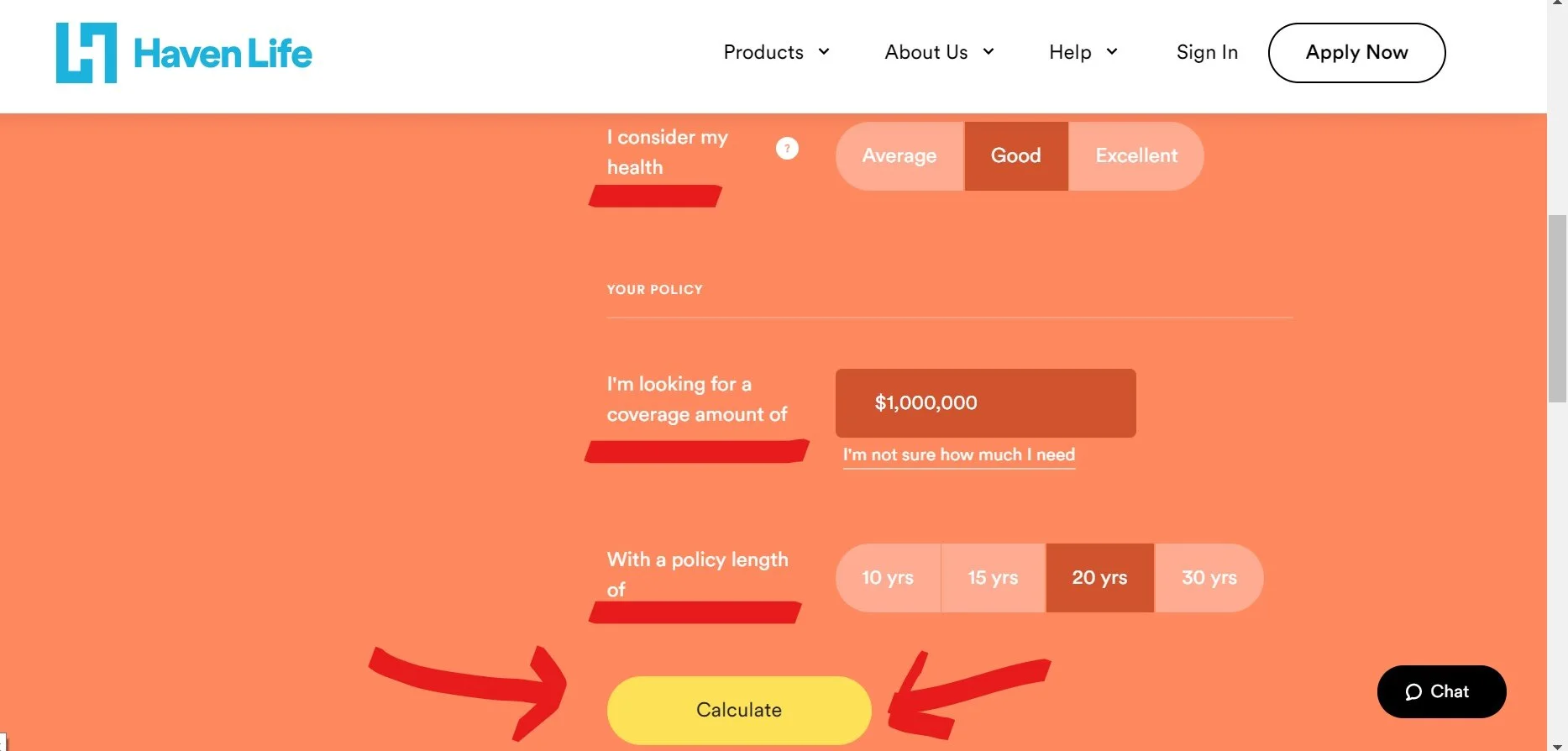

(The quote above is filled out as a 35 year old, 5”4, 140 lb female in New York who has good health and does not use tobacco. She is requesting a term life length of 20 years with $1,000,000 coverage).

STEP 3: Figuring out Your Coverage Amount

While filling out the amount of coverage you desire, you can click their link which is intended to help users find how much coverage is necessary for them. You will be required to fill in your annual income, the amount of members in your family, and your amount of debt. On average, people select the 20-year plan, and the $1,000,000 in coverage, which I did in this example. Coverage Duration and Coverage Amount are necessary to fill out in order to receive an accurate quote.

STEP FOUR: Get Your Quote!

After all of your information is filled out, you will receive a range of estimated finalized monthly quotes. Compared to other companies, Haven Life provides users with a range of possible premiums, which is not nearly as clear cut as others. Reasoning behind this is likely that Haven Life does not want to give an incorrect estimate, so they rather encourage users to sign up for their website and get a real sense for their pricing.

Using this step-by-step guide, you can now go get a quote for Haven Life’s term life insurance!