Irrevocable Life Insurance Trust (ILIT)

In this blog post, we will be discussing what is an irrevocable life insurance trust (ILIT), who should apply for ILIT, when you should apply, where you should apply, and why you should apply for ILIT!

What is an Irrevocable Life Insurance Trust (ILIT)?

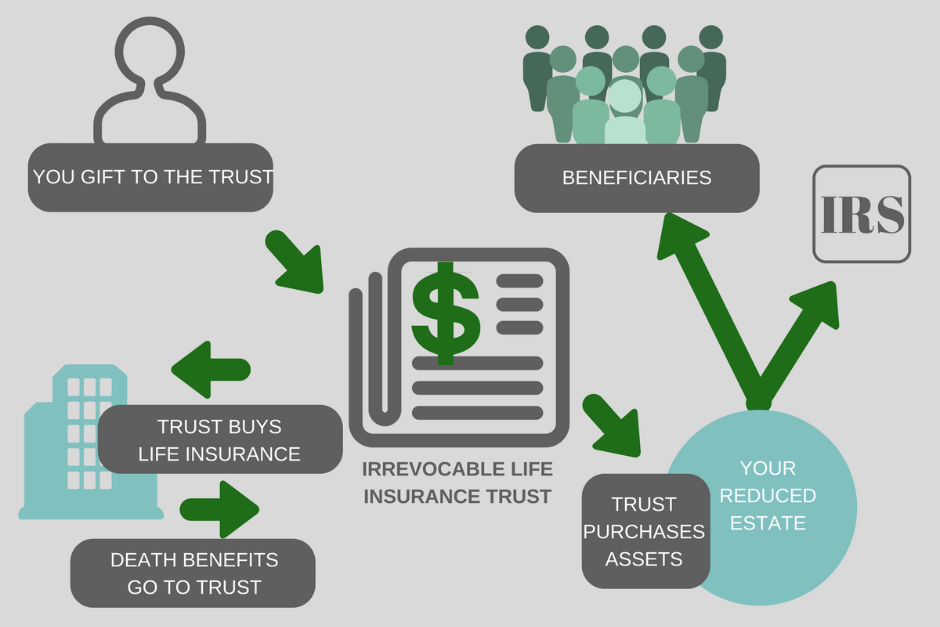

An irrevocable life insurance trust (ILIT) is a trust that facilitates ownership of one or more life insurance policies. This type of trust is funded for your lifetime. It is called irrevocable since once you settle on the agreements, you cannot make any changes.

Who should apply for the Irrevocable Life Insurance Trust (ILIT)?

People who want peace of mind when planning their estate processes should consider ILITS due to its tax reductions or waives. Not only that, but people with lots of assets and wealth should consider ILITs since it helps protect your wealth even after your passing.

When should you apply for the Irrevocable Life Insurance Trust (ILIT)?

There is no specific date when you should apply for Irrevocable life insurance trusts. The majority of the people who do have these trusts have assets and wealth they want to secure. It is usually people who want to avoid tax penalties that set up this trust quicker.

Where can you set up an Irrevocable Life Insurance Trust (ILIT)?

An ILIT is established by the formation of trust. The contributor assigns an existing insurance policy to the trust or trustee of the trust. If you contact any insurance company, they will surely tell you if you are qualified for this type of trust or if it is suitable for you.

Why should you apply for an Irrevocable Life Insurance Trust (ILIT)?

From any average life insurance policy, moving these policies into a trust can provide better advantages. ILITs can avoid your benefit being taxed. When the person dies, the estate taxes and other expenses need to be paid, so the cash provided from ILITs will help. ILITs also is straightforward and direct, stating who, how, and when the death benefit will be used.